Resource Based View Of The Firm - Fannie Mae

Posted by Matthew Harvey on Mar-18-2020

1. The resource-based view of the firm

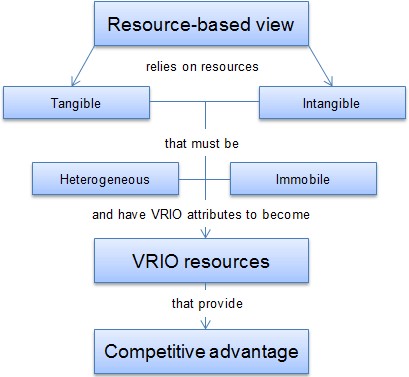

The resource-based view [RBV] is a strategic management tool and framework that is used by companies and organizations to identify and exploit the resources available strategically so as to create a sustainable competitive advantage for the organization in the long run. The RBV framework is based on assessing and identifying resources that will prove to add competitiveness to an organization, and aligning them strategically.

According to the RBV, all organizations and firms have access to and possess and control resources which allows them to build a comparative advantage. A subset of these resources, in turn, allows superior long term performance as well. From these resources further, possession and control of valuable resources may lead to long term, sustainable competitive advantage.

Figure 1 Resource-Based View of the Firm

The RBV categorizes resources available to the firm broadly as being tangible or intangible in nature.

2. Tangible resources

Tangible resources include those resources that are physical in nature and can be easily identified by the organization and competitors. Moreover, these resources can easily be brought from the market, or developed in the long run. Based on this fact, where competitors may acquire identical, or similar resources In the future, they provide little to negligible competitive advantage to the company.

Tangible resources available at Fannie Mae include, for example:

2.1. Land

The land is a tangible resource for Fannie Mae which includes all spaces owned and rented by the company for purposes of hosting production units as well as for warehousing purposes. Additionally, all units owned or rented by the company for purposes of packaging are also included to be tangible resources under the land.

2.2. Equipment

For Fannie Mae, equipment is also a tangible resource that includes all the equipment owned by the company for purposes of production and packaging, as well as other operational purposes. In this manner, all technological advancements, and technological integration for improving processes and operations may also be seen as an extension of equipment thatthe company employs to enhance its product line, and incorporate economies of scale.

2.3. Materials

Materials include all the raw materials and other packaging materials that Fannie Mae uses for the successful production and packaging of its products. The materials are tangible in nature, and may also easily be accessed by the competitor players for their own production processes and other purposes.

2.4. Supplies

Fannie Mae, supplies is also a tangible resource and include all materials and products that are used and needed for supporting the packaging and production functions of the company. Supplies also include all products and supporting materials that are needed by other functions in the Fannie Mae for the successful attainment of business goals and targets.

2.5. Facilities

Facilities are also a tangible resource that is visibly identifiable by competing players with respect to Fannie Mae. The facilities include all the production units, warehouses, offices and supporting buildings and functions for the company which help it in streamlining its processes and operations, and also lead to successful performance. Facilities also include the interior design and interiors of buildings at Fannie Mae – designed for optimizing performance and maintaining brand image.

2.6. Infrastructure

This includes all the land and facilities in terms of technology, buildings, office materials and maintenance, and allocation of power resources such as electricity to its plants by Fannie Mae. The infrastructural buildup is an important resource for the company for ensuring high performance, and ease of operations for the company. However, like other tangible resources, it may be accessed easily by competing players – who may develop similar resources for their own products and functions in the future.

3. Intangible resources

Intangible resources refer to those resources that have no physical value but are still owned and possessed by organizations such as Fannie Mae. Competing players are more than often unable to purchase, or acquire the intangible resources available to Fannie Mae because of associated factors and aspects of historical uniqueness, causal ambiguity, and social complexity. Intangible resources are largely inimitable and likely to stay within the organization over the long run as well, and thus form the basis of competitive advantage for Fannie Mae. The intangible resources for Fannie Mae are also seen to be a 9source of the firm’s success because they are not easily replicated in factor markets by competing players. For Fannie Mae, some intangible resources include, for example:

3.1. Brand reputation

Brand reputation for Fannie Mae is built over historical uniqueness where the brand has worked hard to provide high-quality products and earn consumer trust over decades. The company’s brand reputation – based on its organizational culture and unique relation with customers –can not be imitated by the competitors, and may become a source of competitive advantage.

3.2. Intellectual property

Fannie Mae’s production processes and its product uniqueness is safeguarded by intellectual property rights which prevent other competing players from copying or having access to its unique product blend, and product ingredients and inputs. This ensures novelty to Fannie Mae and makes its products inimitable for competing players.

3.3. Patents and Copyright

Fannie Mae enjoys patents and copyrights not only for its production processes and product composition but also for research and development activities that it undertakes for product improvement and enhancement. These patents and copyrights protect Fannie Mae against potential encroachments or imitation.

3.4. Goodwill

The goodwill for Fannie Mae is again developed through historical uniqueness where the brand’s reputation and customer experience have allowed the development of long-standing goodwill for the company. This, In turn, has enhanced the overall brand equity for Fannie Mae. The goodwill for the company has developed over a long period of time through continuous hard work by the Fannie Mae brand, and cannot be copied by the competing players.

3.5. Trade names

The trade name is also an intangible resource for the company as other players cannot adopt or imitate this name. The trade name is recognizable by the customers, and provide instant recognition for the company across borders. The trade name also communicates the brand promise and values to customers globally and is a source of competitive advantage for the company.

3.6. Customer experience

Fannie Mae provides a unique customer experience to its customers through its brand activities, and offerings – as well as marketing activities. Though marketing activities may be copied by competing players, the strategic direction and intent with which the customer experience and brand activities are planned is inimitable and prides a unique source of competitive advantage to Fannie Mae.

3.7. Patented technology, computer software, databases and trade secrets

Fannie Mae is also successful in its operations and businesses and has a large customer following that is loyal and does repetitive purchasing because of its trade secrets – which also comprises of having a secret recipe for product competition. Fannie Mae also regularly develops and incorporates advanced technology that is developed internally and is thus patented. This includes hardware and software for improving the company’s operational [processes, and as such, provide an edge to the business in factor markets.

3.8. Video and audiovisual material (e.g. Motion pictures, television programs)

All marketing content, and video and audio-video material designed, developed, launched, and released by Fannie Mae is also an intangible resource. Though this marketing content has little physical value, it contributes towards brand building for Fannie Mae and works towards increasing brand awareness, brand recognition, and overall brand equity. Since this material is guided by a broader arching business and marketing strategy, the marketing content developed by Fannie Mae is inimitable by players in factor markets.

3.9. Customer lists

Fannie Mae has a variety of different product lines and product offerings for different target groups and target consumer markets. Moreover, the company operates internationally and has consumer markets in over 100 countries. Based on this, it is safe to state that Fannie Mae has developed unique customer markets – that share similar characteristics – in different countries. Moreover, this customer market comprises of different consumer groups and categories. As such, Fannie Mae has unique customer lists in different countries, and this can’t be imitated largely because of social ambiguity attached.

3.10. Licensing, royalty and standstill agreements

Fannie Mae has developed unique licensing, royalty and standstill agreements over time in the different consumer markets it operates. These have been developed strategically over time through continuously consistent and successful performance by the company, and because of brand development from functional to emotional to lifestyle in nature. Based on this progress of the brand, and brand characteristics, along with strategic leadership and vision – Fannie Mae has been able to develop inimitable licensing, royalty, and standstill agreements that allow its competitive positioning in factor markets.

3.11. Import quotas

Fannie Mae has developed strategic contracts with different countries for import quotas. These quotas include not only the final packaged products but also unique raw materials and its import in different countries for supporting the business processes. As such, the defined import quotas cannot be imitated by other companies since they are based on the unique position of The Fannie Mae and its strategic direction.

3.12. Franchise agreements

Fannie Mae has unique franchise agreements with reliable partners in different companies for production as well as for distribution and sale purposes. This has allowed the company access to different markets while safeguarding it culturally and financially against potential risks. The franchising agreements are also intangible in nature and based on unique, trustworthy relationships upheld by Fannie Mae.

3.13. Customer and supplier relationships (including customer lists)

Fannie Mae has unique customer and supplier relationships. The customer and supplier relationships have developed over time through consistent behaviour, trust-building, and transparency in operations and intent. The strong customer and supplier relationships help Fannie Mae informing global networks that are well managed, and smoothly undertaken – and largely inimitable by competitors in the immediate future.

3.14. Marketing rights

The company’s marketing rights in different countries are based on strategic leadership and strategic direction, as well as the company’s legal compliance and history. This cannot be imitated by other players, and cannot be acquired by them as well. This is because Fannie Mae has developed them over time, and through stringent processes and means – allowing it a unique standing over other players in competing markets.

4. Heterogeneous and immobile characteristics of resources

The RBV for firms holds that all resources possessed, controlled and owned by organizations have two core characteristics – of heterogeneity and immobility.

4.1. Heterogeneity

Under heterogeneity, the RBV assumes that resources based on skills and capabilities – for example in the form of human resource activities, training, and talent, varies from company to company. This variation is important for avoiding the building of characteristics of perfect competition. As such, with heterogeneity, the RBV assumes that each organization has a different amount and mix of resources – which lead to different strategic directions and strategic choices to them – under similar external pressures and conditions.

This means that the strategic decision and choice undertaken by Fannie Mae will differ substantially from its competition under similar external environmental pressures based on the different mix of resources available to the company. This assumption of heterogeneity under RBV allows Fannie Mae to complete product and outperform the competition in facto markets, and also achieve competitive advantage through its use of unique resource bundles and mixes.

4.2. Immobility

Under the assumption of immobility, the RBV assumes that resources available to the firm are not mobile, and cannot be transferred from one organization to another – in the short run at the least. Based on this notion of immobility in the short run, the RBV assumes that rival companies are unable to imitate, and replicate resources available to Fannie Mae, and devise and implement strategies and decisions similar to that of Fannie Mae. Intangible resources are largely immobile in nature.

All intangible resources available to Fannie Mae are heterogeneous and immobile in nature at large. The tangible resources are also immobile in nature in the short run for Fannie Mae and maybe homogeneous to the player in the factor markets depending on the advancement, and strategic developments of competing players.

5. VRIO analysis

The characteristics of heterogeneity and immobility are not sufficient for Fannie Mae in using resources to develop a competitive advantage. To determine if resources can be used and enhanced to develop a competitive advantage in the long run with sustainability, it is important that resources identified for the company to fulfill the VRIO criteria.

Figure 2VRIO analysis with respect to competitive advantage and RBV

The VRIO framework assesses tools on criteria of being valuable, rare, inimitable, and organization. For Fannie Mae, the VRIO strategic tool may be applied to the identified resources to determine if the resources allow the building of competitive advantage over the long run. For Fannie Mae, this is seen as:

| Resource | Valuable | Rare | Inimitable | Organized | Advantage |

| Land | Y | N | N | Y | Competitive parity |

| Equipment | Y | N | N | Y | Competitive parity |

| Materials | Y | N | N | Y | Competitive parity |

| Supplies | Y | N | N | Y | Competitive parity |

| Infrastructure | Y | N | N | Y | Competitive parity |

| Facilities | Y | N | N | Y | Competitive parity |

| Brand reputation | Y | Y | Y | Y | Competitive advantage |

| Intellectual property | Y | Y | Y | Y | Competitive advantage |

| Patents and copyrights | Y | Y | Y | Y | Competitive advantage |

| Goodwill | Y | Y | Y | Y | Competitive advantage |

| Trade names | Y | Y | Y | Y | Competitive advantage |

| Customer experience | Y | Y | Y | Y | Competitive advantage |

| Patented technology, computer software, databases and trade secrets | Y | Y | Y | Y | Competitive advantage |

| Video and audiovisual material | Y | Y | N | Y | Temporary competitive advantage |

| Licensing, royalty and standstill agreements | Y | Y | N | Y | Temporary competitive advantage |

| Customer lists | Y | Y | Y | Y | Competitive advantage |

| Import quotas | Y | Y | N | Y | Temporary competitive advantage |

| Franchise agreements | Y | Y | N | Y | Temporary competitive advantage |

| Customer and supplier relationships | Y | Y | N | Y | Temporary competitive advantage |

| Marketing rights | Y | Y | N | Y | Temporary competitive advantage |

| HRM skills | Y | Y | Y | Y | Competitive advantage |

6. Competitive advantage

Competitive advantage is defined as circumstances or possession and control of resources that put Fannie Mae in a superior and favorable business position. These resources and circumstances have allowed Fannie Mae to outperform other players in factor markets in different countries and also allowed it to create a unique customer base with high demand for its unique product offerings and high-quality products. However, competitive advantage develops in the long run, and is generally sustainable since the resources that a company owns, controls or possesses successfully fulfill al VRIO criteria.

When resources available to Fannie Mae are heterogeneous, and immobile in nature but successfully fulfill only some VRIO criteria, other forms of advantage are formed for the company. This include:

| Competitive disadvantage | The competitive disadvantage for Fannie Mae would be the possession of resources that are not valuable at all, and may lead to the company performing unfavorably in relation to competition, and may lead the company to underperform. |

| Competitive parity | Resources that lead to the building of competitive parity for Fannie Mae are those that allow the company to achieve the standard and average results and performance in an industry. |

| Short term competitive advantage | This refers to a superior business edge and benefits enjoyed by Fannie Mae. However, this is more temporary in nature as the resources may be imitated by competition and players in factor markets in the future. They may similarly, also be acquired by players in the factor markets over time. As such, though they provide Fannie Mae with a competitive advantage, this is only temporary in nature, and not sustainable. |

| Competitive advantage | A superior edge developed by Fannie Mae on the basis of its resources is sustainable and lasts over the long run as well. This is generally inimitable by the competition and has developed through historical values attached. Fannie Mae is able to exploit resources to build a competitive advantage further in a sustainable manner. |

7. References

Barney, J.B. and Hesterly, W.S., 2010. Strategic management and competitive advantage: Concepts and cases (pp. 4-25). Upper Saddle River, NJ: Prentice Hall.

Barney, J.B., Ketchen Jr, D.J. and Wright, M., 2011. The future of resource-based theory: revitalization or decline?. Journal of management, 37(5), pp.1299-1315.

Cole, G., 2003. Strategic Management. Boston: Cengage Learning EMEA..

David, F. and David, F.R., 2016. Strategic management: A competitive advantage approach, concepts and cases. Pearson–Prentice Hall.

Hill, C.W., Jones, G.R. and Schilling, M.A., 2014. Strategic management: theory: an integrated approach. Cengage Learning.

Hitt, M.A., Xu, K. and Carnes, C.M., 2016. Resource based theory in operations management research. Journal of Operations Management, 41, pp.77-94.

Johnson, G., 2016. Exploring strategy: text and cases. Pearson Education.

Kamasak, R., 2017. The contribution of tangible and intangible resources, and capabilities to a firm’s profitability and market performance. European Journal of Management and Business Economics.

Kozlenkova, I.V., Samaha, S.A. and Palmatier, R.W., 2014. Resource-based theory in marketing. Journal of the Academy of Marketing Science, 42(1), pp.1-21.

Kraaijenbrink, J., Spender, J.C. and Groen, A.J., 2010. The resource-based view: A review and assessment of its critiques. Journal of management, 36(1), pp.349-372.

Kunc, M.H. and Morecroft, J.D., 2010. Managerial decision making and firm performance under a resource‐based paradigm. Strategic Management Journal, 31(11), pp.1164-1182.

Lin, Y. and Wu, L.Y., 2014. Exploring the role of dynamic capabilities in firm performance under the resource-based view framework. Journal of business research, 67(3), pp.407-413.

McWilliams, A. and Siegel, D.S., 2011. Creating and capturing value: Strategic corporate social responsibility, resource-based theory, and sustainable competitive advantage. Journal of Management, 37(5), pp.1480-1495.

Montgomery, C.A. ed., 2011. Resource-based and evolutionary theories of the firm: towards a synthesis. Springer Science & Business Media.

Nath, P., Nachiappan, S. and Ramanathan, R., 2010. The impact of marketing capability, operations capability and diversification strategy on performance: A resource-based view. Industrial Marketing Management, 39(2), pp.317-329.

Özçelik, G., Aybas, M. and Uyargil, C., 2016. High performance work systems and organizational values: Resource-based view considerations. Procedia-Social and Behavioral Sciences, 235(24), pp.332-341.

Puranam, P. and Vanneste, B., 2016. Corporate strategy: Tools for analysis and decision-making. Cambridge University Press.

Rothaermel, F.T., 2016. Strategic management: concepts (Vol. 2). McGraw-Hill Education.

Wheelen, T.L., Hunger, J.D., Hoffman, A.N. and Bamford, C.E., 2010. Strategic management and business policy. Upper Saddle River, NJ: Prentice Hall.

Witcher, B. & Chau, v., 2010. Strategic Management: Principles and Practice. New York: Cengage Learning EMEA.

Wu, L.Y., 2010. Applicability of the resource-based and dynamic-capability views under environmental volatility. Journal of Business Research, 63(1), pp.27-31.

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here.

Related Articles

- Corporate Social Responsibility of Fannie Mae

- Fannie Mae 5C Marketing Analysis

- The vision statement of Fannie Mae

- Organizational Culture of Fannie Mae

- Fannie Mae Generic and Intensive Growth Strategies

- Marketing Mix Fannie Mae

- Fannie Mae PESTEL & Environment Analysis

- Fannie Mae Porter Five Forces Analysis

- Fannie Mae SWOT Analysis / SWOT Matrix

- Value Chain Analysis Of Fannie Mae

- Marketing Strategy Of Fannie Mae

- Fannie Mae Case Solution

- Ansoff Matrix of Fannie Mae

- Blue Ocean Strategy of Fannie Mae

- Hofstede Cultural Model of Fannie Mae

- Porters Diamond Model of Fannie Mae

- Mckinsey 7s Framework Of Fannie Mae

- VRIN/VRIO Analysis Of Fannie Mae

- Net Present Value (NPV) Analysis of Fannie Mae

- WACC for Fannie Mae

Ariana Taylor

5.0

Thanks for another great paper!

Shannon Callum

5.0

I would use this company again. I'll keep in touch with you guys within three days. Thank you!

Ninca Jonathan

5.0

I have the need to complete the document ASAP and they delivered it in 6 hours. Thanks!

Orsolya Mate

5.0

Definitely ordering again if required. Affordable prices, plagiarism-free papers and timely procedure. I’m heartily grateful!

Xin Lai

5.0

Just because of this website my assignment was different in the class that's why I obtained the highest marks.

Mayra Medina

5.0

Fixed time was two days for the assignment but it made me happy when I got hold of the paper within 20 hours.

Next Articles

- 12624-Kroger-Resource-Based-View

- 12625-Amazon-com-Resource-Based-View

- 12626-Walgreens-Boots-Alliance-Resource-Based-View

- 12627-HP-Resource-Based-View

- 12628-Cardinal-Health-Resource-Based-View

- 12629-Express-Scripts-Holding-Resource-Based-View

- 12630-J-P-Morgan-Chase-Resource-Based-View

- 12631-Boeing-Resource-Based-View

- 12632-Microsoft-Resource-Based-View

- 12633-Bank-of-America-Corp-Resource-Based-View

Previous Articles

- 12622-Costco-Resource-Based-View

- 12621-Chevron-Resource-Based-View

- 12620-Verizon-Resource-Based-View

- 12619-AmerisourceBergen-Resource-Based-View

- 12618-General-Electric-Resource-Based-View

- 12617-AT-T-Resource-Based-View

- 12616-Ford-Motor-Resource-Based-View

- 12615-General-Motors-Resource-Based-View

- 12614-CVS-Health-Resource-Based-View

- 12613-UnitedHealth-Group-Resource-Based-View

Be a Great Writer or Hire a Greater One!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Essay48 with BIG enough reputation.

Our Guarantees

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!