Porters Diamond Model of Fannie Mae

Posted by Matthew Harvey on Apr-15-2020

1. What is Porter’s diamond model?

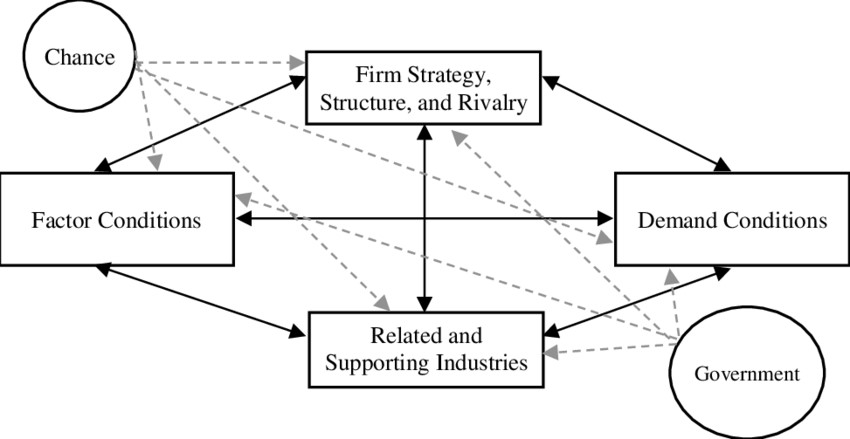

Michael Porter’s Diamond Model, which is also popularly known as the Theory of National Competitive Advantage of Industries is a strategic tool used by companies for determining and developing the basis of competitive advantage needed for international growth and expansion. The strategic model is shaped like a diamond and comprises of elements within a framework that determine the case on international competitiveness for a firm within any given industry. The elements within the framework are interconnected, and also interactive, and include Firm Strategy, Structure and Rivalry; Factor Conditions; Demand Conditions; and Related and Supporting Industries.

Table 1Porter's Diamond Model

For Fannie Mae, these conditions and elements have been particularly favorable in helping the firm boost its growth internationally with continuous innovation and up-gradation. As a result, by focusing on these elements and their refinement, Fannie Mae has been able to become one of the eluding beverage brands across the globe in different countries.

2. Factor conditions

Factor conditions are elements and aspects that provide a competitive advantage to the industry and its firms. However, unlike natural resources, factor conditions are usually developed by the country at large. For Fannie Mae, the factor conditions include the following:

2.1. Natural resources

These are the natural resources available to Fannie Mae in its home country, as well as in the countries where it has set up operational and production plants. These include, for example, the presence of natural resources such as water channels. These natural resources are available to a firm because of its location and are relatively cheaper for the firm to access. They do not need to be developed or created but refined for usage generally.

2.2. Capital resources

These include the financial resources that are available to Fannie Mae. For Fannie Mae, these are available through equity capital resources and debt financial resources. Equity-based capital is largely generated within the company, using internal resources and channels only. Debt-based capital, on the other hand, involves debt taking from external sources and organizations.

2.3. Human resources

This includes the skill levels, and performance of the human resources at the Fannie Mae. It also involves the training programs and all other investment programs undertaken by Fannie Mae in relation to its human resources and employees across the globe. It also includes all human resource functions from recruitment to performance management which work towards employee development and growth.

2.4. Scientific knowledge

This involves the scientific and technical knowledge available to a firm and its knowledge base. This may be acquired through countrywide resources, industry-wide resource, or resources specific toe firm. Scientific knowledge is important for a firm in developing a competitive advantage that helps it stand out from its competing players.

2.5. Technological innovation

The presence of scientific knowledge will also lead to frequent innovations – technologically s well as otherwise. Technological innovations are important in helping firms achieve economies of scale and reduce overhead costs and other operational costs to be able to expand into other markets with profit maximizations.

2.6. Infrastructure

The infrastructure is also an important factor condition for Fannie Mae which has helped it grow and expand- not only locally but also globally. The infrastructure includes the physical as well as the technological network that has allowed Fannie Mae to successfully complete and carry out operations in other countries and markets.

This infrastructure is largely developed by the country itself based on internal resources. However, in cases of firm need and market potential, firms such as Fannie Mae have also engaged in developing the local infrastructure – which has not only helped the firm in the development but has also led to the growth and development of the society and market where it has expanded to.

3. Related and supporting industries

The presence of supporting and competing players in the industry provide positive pressure and encourage mantra to players in the industry towards excelling and expanding through innovation and internationalization. For Fannie Mae, the supporting and related industries have also been particularly helpful in leading the brand into achieving new heights with every passing year.

3.1. Presence of related industries

The presence of related industries in domestic and international markets has also been a source of growth and development in terms of expansion and internationalization for Fannie Mae. This is because related industries have helped Fannie Mae in the business operations by providing support materials needed for successful operational excellence. Fannie Mae, for example, has been able to source packaging materials, and raw materials locally in different consumer markets, which have helped it control costs and expenses, and achieve economies of scale.

3.2. Presence of supporting industries

The presence of supporting industries is a facilitator for Fannie Mae in growing and expanding its business. This is true for the presence of supporting industries in domestic as well as international markets. In domestic markets, supporting industries have helped the development of the overall industry, which in turn has also allowed firms like Fannie Mae in progressing and developing in business operations and attracting consumers and creating awareness in customer markets for product awareness and recognition.

3.3. Presence of rival industries

The presence of rival industries is also an important factor for the growth and development of business operations and growth for Fannie Mae internationally. This is because rival industries have pressured the firm’s own industry into developing, and advancing to be able to perform better and maintain its share of the consumer pie in the market. In pressuring Fannie Mae’s industry and related firms towards excelling and efficiency, rival firms also pave the path for growth. This is either done by pressuring the firm’s industry to explore new markets, or by expanding first and allowing the firm’s industry to copy the expansion prices. For Fannie Mae, rival industries have pressured the company to not only perform better but explore new markets for increasing revenue streams.

3.4. Presence of strong global suppliers

The presence of strong global suppliers is one of the most important and basic sources of developing competitive advantage for international markets, and for ensuring product availability across different consumer markets. Fannie Mae has a strong network of global suppliers which help it distribute its products to different consumer markets, and make them easily visible and accessible for consumers. These global suppliers are selected against defined criteria and benchmarks to ensure quality consistency and effective processes throughout the markets.

4. Strategy, structure, and rivalry

This refers to the company’s strategic focus and its managerial and organizational structure and architecture. The organizational leadership and set up is important for determining the international expansion of the company and firm. For Fannie Mae the organizational structure, and set up as well as the strategic vision and decisions have been important in facilitating the company’s international growth and expansion.

4.1. Company strategy

Fannie Mae’s strategy is to focus on customers to provide them with high-quality products that offer continually consistent quality and taste in the offering. Fannie Mae promises value for money and satisfaction to customers and designs its strategic focus and decisions in the same manner – to allow maximization of value for money to customers through efficient processes that also lead to cost-saving for the company.

4.2. Structure of the organizations

Fannie Mae is a flatter organization that supports open and free communication. The company offers easy and quick access to managers and supervisors, and thus allows a creative and trusting organizational culture that helps in the growth and progress of the company. Moreover, the flatter organization also allows employees at Fannie Mae to easily approach and discuss matters with the leadership at Fannie Mae.

4.3. Managerial system

The managerial system at Fannie Mae is supportive that works towards employee growth and development. Supervisors and managers work continually with employees to help them develop personally and professionally. Fannie Mae has designed a number of different training programs for the same purpose, and employees have suggested these programs based on their skill gaps, and performance levels.

4.4. Intense competition between local rivals

Competition with local rivals influences its strategic development and focus. The company is often pressured into creatively exploring novice ways and technology to incorporate these into its routine operations. In this way, intense competition with local and domestic players has allowed Fannie Mae to introduce novice processes and technologies to develop unique competitive and cost advantages for Fannie Mae to help it attract a greater number of consumers.

4.5. Competition with global players

With global competition, Fannie Mae has gained an understanding of different regional and international business practices and cultures which have helped it develop more intricate, and region-specific products and offerings. The global competition has also allowed Fannie Mae to predict global trends and consumer behavior patterns which in turn have allowed the firm to maintain a competitive advantage internationally.

5. Government

This refers to how governments can influence firm performance and its growth plan through its various policies as well as border relations with other countries one global front. For Fannie Mae, government policies and structures across different countries have been particularly favorable.

5.1. Government policies

Government policies have supported Fannie Mae in its expansion and growth plans and opportunities. Fannie Mae has received support from its home country for expanding production capacities, and also from foreign governments in setting up plants and gaining access to import and export quotas for different regions. Moreover, the government trade policies between different countries have also benefited Fannie Mae in expanding its business internationally.

5.2. Industry regulations

The industry regulations for Fannie Mae have also been supportive of the firm in maintaining and developing its competitive advantage towards sustainability. Industry regulations for Fannie Mae also ensure the consistent maintenance of quality in Fannie Mae products. Moreover, industry regulations have also allowed Fannie Mae to develop efficiency in its products through technological advancement, and the development of scientific and technological knowledge for supporting business advancement.

5.3. Government as a catalysts

The government has acted as a catalyst for Fannie Mae on a number of occasions. By being a catalyst, the government has supported Fannie Mae’s business operations and developmental plans. This has been done by providing the company with infrastructural capacities and benefits for example. The government has also been a catalyst in facilitating the business meet its demand, and with its various internal consume related policies and regulations which have allowed Fannie Mae to design marketing programs and develop products that meet the needs of consumers locally as well as in other markets.

5.4. Government as a challenger

The government has also been a challenger for Fannie Mae. This has also helped the business in its growth strategy. The government has been a challenger especially in its relation with other countries which in turn have had an impact on the business relations that Fannie Mae has with foreign consumers and markets, as well as foreign agents and distributors. However, these challenges that have sprouted from the governments and its relations with other countries and regions, have helped Fannie Mae develop contingency plans and have helped it develop strategies to be able to use strengths to ward off potential threats and weaknesses successfully.

6. Chance events

Chance events in the model refer to those events and conditions in potential markets that are not likely to occur with surety but instead, will provide opportunities, or threats to firms on their occurrence – depending on the risks taken by the firms. For Fannie Mae, chance events have included:

6.1. Random events

Random events may affect the Fannie Mae business positively or negatively – depending on the nature and timeliness of occurrence. Random events have influenced Fannie Mae in different manners, depending on how they impact the business operations and marketing communications of the company at large. Random events are important for Fannie Mae for its business growth and operations internationally in search of new opportunities, as well as to overcome threats and problems in existing markets.

6.2. Natural disasters

Natural disasters block the business for Fannie Mae in their occurrence. Business activities and operations for routine are disrupted and often halted because of natural disasters. Additionally, consumer markets and activities are also halted and disrupted – and often channeled towards other behavior and activities which lead to disturbing the product activities, and business operations for Fannie Mae.

6.3. Scientific breakthroughs

Scientific breakthroughs support the operations and activities of Fannie Mae by providing it with support and advancement opportunities technologically s well as for operational processes. Fannie Mae has benefitted from scientific breakthroughs in its internationalization processes and plans by having the technological knowledge and advancement that supports its production capacities and other business operations and activities.

6.4. Terrorist activities

These hamper business operations and activities for Fannie Mae by blocking its access to specific consumer markets and regions. The company is unable to carry out the operation in regions targeted with terrorist activities with respect to not only production but also import quotas. Moreover, terrorist activities also influence sales and marketing campaigns of the com0any in specific regions – depending on the political friction of the government with other governments and markets.

7. Demand conditions

Demand conditions are those events and conditions that lead to the success of a firm in any given market Local, and home demand is important in not only exposing a firm to the challenges of a bigger market, but are also important I pushing the firm towards expansion, and possibilities of expansion.

7.1. Size of the domestic market

The size of the domestic market has been important for Fannie Mae in its internationalization and expansion measures. This is because of two primary reasons. Firstly, the increased size of the local markets and domestic consumers is important for companies to understand the dynamics at play with larger markets, and helps them strategize, and plan operations accordingly. This increased market size and domestic players have allowed Fannie Mae to measure and identify its own strengths and weaknesses with respect to growth, and contain them accordingly. Secondly, larger market size is also important for pushing the firm, and brand into exploring the possibility of expansions and new markets.

7.2. Sophisticated and demanding domestic customers

Sophisticated and demanding domestic sounders for Fannie Mae have pushed the firm into utilizing its resources towards innovation, and have led the firm into developing unique products for the customers. With demanding domestic consumers firms such as Fannie Mae have been able to realize their crate and innovative capabilities, and have put them into use to develop new products, or processes to help the business grow.

7.3. Customer needs that anticipate those elsewhere

Domestic consumers and consumer behaviour patterns are also important for predicting and anticipating the behaviour and demands of consumers in other markets. For consumers with the same profile, companies can often predict behavior of market-specific consumers in relation to the behaviour displayed by the same profile consumers in other markets.

Firms like Fannie Mae can also influence the behaviour of the consumers in one market based on the response they have received in another market. This is important for strategic development within the firm for global strategies as well as global expansion and development in other countries and markets.

8. References

Bakan, I. and Doğan, İ.F., 2012. Competitiveness of the industries based on the Porter’s diamond model: An empirical study. International Journal of Research and Reviews in Applied Sciences, 11(3), pp.441-455.

Dagnino, G.B. ed., 2012. Handbook of research on competitive strategy. Edward Elgar Publishing.

Eickelpasch, A., Lejpras, A. and Stephan, A., 2010. Locational and internal sources of firm competitive advantage: Applying Porter’s diamond model at the firm level.

Fainshmidt, S., Smith, A. and Judge, W.Q., 2016. National competitiveness and Porter's diamond model: The role of MNE penetration and governance quality. Global Strategy Journal, 6(2), pp.81-104.

Harding, S., 2017. MBA management models. Routledge.

Johnson, G., 2016. Exploring strategy: text and cases. Pearson Education.

Márkus, G., 2008. Measuring company level competitiveness in Porter's Diamond model framework. In FIKUSZ 2008 Business Sciences-Symposium for Young Researchers: Proceedings (pp. 149-158).

Ozgen, E., 2011. Porter's diamond model and opportunity recognition: a cognitive perspective. Academy of Entrepreneurship Journal, 17(2), p.61.

Rothaermel, F.T., 2016. Strategic management: concepts (Vol. 2). McGraw-Hill Education.

Rugman, A.M. and Verbeke, A., 2017. Global corporate strategy and trade policy. Routledge.

Smit, A.J., 2010. The competitive advantage of nations: is Porter’s Diamond Framework a new theory that explains the international competitiveness of countries?. Southern African Business Review, 14(1).

Thompson, A., Strickland, A.J. and Gamble, J., 2015. Crafting and executing strategy: Concepts and readings. McGraw-Hill Education.

Vlados, C., 2019. Porter’s diamond approaches and the competitiveness web. International Journal of Business Administration, 10(5), pp.33-52.

Zhang, P. and London, K., 2013. Towards an internationalized sustainable industrial competitiveness model. Competitiveness Review: An International Business Journal.

Zhao, L., 2018, August. Determinants of Food Industry Competitiveness in China from the Perspectives of Porter's Diamond Model. In the 3rd International Conference on Judicial, Administrative and Humanitarian Problems of State Structures and Economic Subjects (JAHP 2018). Atlantis Press.

Gamble, J.E., Peteraf, M.A. and Thompson, A.A., 2014. Essentials of strategic management: The quest for competitive advantage. McGraw-Hill Education.

Epstein, M.J., 2018. Making sustainability work: Best practices in managing and measuring corporate social, environmental and economic impacts. Routledge.

Sinfield, J.V., Calder, E., McConnell, B. and Colson, S., 2012. How to identify new business models. MIT Sloan management review, 53(2), pp.85-90.

Morden, T., 2016. Principles of strategic management. Routledge.

Alkhafaji, A. and Nelson, R.A., 2013. Strategic management: formulation, implementation, and control in a dynamic environment. Routledge.

9. Appendix

Table 2 Summary Porter's Diamond Model

| Factor conditions |

|

| Related and supporting industries |

|

| Strategy, structure, and rivalry |

|

| Government |

|

| Chance events |

|

| Demand conditions |

|

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here.

Related Articles

- Corporate Social Responsibility of Fannie Mae

- Fannie Mae 5C Marketing Analysis

- The vision statement of Fannie Mae

- Organizational Culture of Fannie Mae

- Fannie Mae Generic and Intensive Growth Strategies

- Marketing Mix Fannie Mae

- Fannie Mae PESTEL & Environment Analysis

- Fannie Mae Porter Five Forces Analysis

- Fannie Mae SWOT Analysis / SWOT Matrix

- Value Chain Analysis Of Fannie Mae

- Marketing Strategy Of Fannie Mae

- Fannie Mae Case Solution

- Ansoff Matrix of Fannie Mae

- Blue Ocean Strategy of Fannie Mae

- Hofstede Cultural Model of Fannie Mae

- Mckinsey 7s Framework Of Fannie Mae

- Resource Based View Of The Firm - Fannie Mae

- VRIN/VRIO Analysis Of Fannie Mae

- Net Present Value (NPV) Analysis of Fannie Mae

- WACC for Fannie Mae

Yu Bai

5.0

I desire to refer this service to all of those students who are in a situation as I was. Good prices and no plagiarism. Great job!

Sophie Mats

5.0

This company covers a wide range of academic documents. Additionally writers know how to write well.

Charlie Finn

5.0

Got the good grades because of the project and the task was fulfilled on the committed time.

Louca Christophe

5.0

Fairly prices and true value for money. I got what I was seeking: on-time delivery and no plagiarism. Thanks a lot!

Zhang David

5.0

This writing service is the best one. Thanks a lot for the dissertation, it's really right.

Joe Thomas

5.0

I would like to refer this service to everyone. Will use this service many more times in the future. Thank you!

Next Articles

- 12624-Kroger-Porters-Diamond-Model

- 12625-Amazon-com-Porters-Diamond-Model

- 12626-Walgreens-Boots-Alliance-Porters-Diamond-Model

- 12627-HP-Porters-Diamond-Model

- 12628-Cardinal-Health-Porters-Diamond-Model

- 12629-Express-Scripts-Holding-Porters-Diamond-Model

- 12630-J-P-Morgan-Chase-Porters-Diamond-Model

- 12631-Boeing-Porters-Diamond-Model

- 12632-Microsoft-Porters-Diamond-Model

- 12633-Bank-of-America-Corp-Porters-Diamond-Model

Previous Articles

- 12622-Costco-Porters-Diamond-Model

- 12621-Chevron-Porters-Diamond-Model

- 12620-Verizon-Porters-Diamond-Model

- 12619-AmerisourceBergen-Porters-Diamond-Model

- 12618-General-Electric-Porters-Diamond-Model

- 12617-AT-T-Porters-Diamond-Model

- 12616-Ford-Motor-Porters-Diamond-Model

- 12615-General-Motors-Porters-Diamond-Model

- 12614-CVS-Health-Porters-Diamond-Model

- 12613-UnitedHealth-Group-Porters-Diamond-Model

Be a Great Writer or Hire a Greater One!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Essay48 with BIG enough reputation.

Our Guarantees

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!