Blue Ocean Strategy of Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

Posted by Matthew Harvey on Oct-01-2020

1. Blue ocean strategy: introduction

The blue ocean strategy seeks to bring differentiation to organizations and brands like Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts to create awareness and presence in a new market place and create demand amongst consumers. The blue ocean strategy focuses on creating demand in the uncontested market space, and by doing this, it makes the competition unrelated and irrelevant. Through the blue ocean strategy, industry players like Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts are able to reconstruct the market boundaries as well as the industry structure through their strategies and actions. Under the blue ocean model and framework, the industry structures are assumed to be flexible, and not rigid.

With Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts, the blue ocean model and framework has allowed the company to explore new market spaces that have not been competitive, or actively utilized by players existing in the present business environment. By doing so, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts has been able to create new demand, rather than fight over and encroach existing competitive space. In doing so, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts has been able to experience rapid growth as well as enjoy increased profits. When Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts adopts the blue ocean strategy, it changes the rules of the game and eradicates the competition – rendering them unimportant, and irrelevant factors of the environment.

For businesses, the blue ocean signifies a deeper section of the ocean that is unexplored and holds unlimited potential and opportunities for growth and expansion. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts adopts the broader blue ocean strategy through different means and frameworks.

2. Blue vs Red Ocean

Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts differs in its adoption of the blue ocean strategy to achieve rapid growth in unexplored market spaces. While Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts also actively pursues the red ocean strategy, it is also an avid follower of the blue ocean strategy. The choice of strategy differs based on the product nature and offerings, as well as the business goals, and market development.

The red and the blue ocean strategy for Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts are different in the following ways

| Red ocean strategy | Blue ocean strategy |

|---|---|

| Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts competes with existing players in existing market spaces, and defined industry boundaries | Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts Creates new market spaces rendering the competition to be irrelevant, and redefines the industry boundaries |

| Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts Tries to grab a share of demand from the existing pie | Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts creates new, and innovative demand, and bakes a new pie altogether |

| Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts Makes the value-cost trade-off | Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts Breaks the value cost trade-off |

| Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts chooses a specific direction for differentiation – based on low cost and related strategic activities | Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts continues pursuit of differentiation through low-cost strategies and activities |

3. Four action framework

The four actions framework by Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts has helped the company explore and refine buyer value more intricately. The Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts Company has made use of the four actions framework in reconstructing or developing new value curves or strategic profiles for the company and its various offerings in uncontested market spaces. However, when a new value curve is created, companies typically face a trade-off between differentiation and low cost. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts has also been able to break this tradeoff by challenging the strategic formation, foundation and logic of the industry – thereby challenging the industry boundaries and working at large.

3.1. The four strategic actions for developing new buyer value curves

Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts breaks the tradeoff through four simple strategic processes and ways – highlighted as the four actions in the four action framework.

3.1.1. Eliminate

With elimination, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts identifies and shortlists the factors through which a given industry has competed over a long period of time, and which may be eliminated now. These factors include, for example, obsolete technology, mundane operational processes, and stringent human resource policies.

3.1.2. Raise

Under this option, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is able to identify the factors that it wants to rise well above the industry’s average in its own settings and operations. These factors will give the company an edge over other players and will provide it with a competitive advantage. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts, therefore, focuses on developing these factors for a sustainable advantage. These factors include, for example, its organizational culture, human resource training and policies, technological innovation, and market research capabilities – for example.

3.1.3. Create

Under the action of create, the Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is able to develop and identify strategic factors and capacities that are new to the industry at large, and have never been introduced before. With these capacities, the company is able to maintain and control costs, and is at the same time, able to offer higher value to the buyers. The company is also able to create sustainable advantage and a refined first-mover advantage through the development of these capacities that will give it a sustainable advantage.

3.1.4. Reduce

Under this strategic option and choice, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts assesses and reviews a given industry, and identifies factors and aspects that it should reduce in its expansion plans to be able to maximally benefit from untapped market spaces and related opportunities. These factors are reduced considerably in comparison to industry standards.

4. Six path framework

Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts makes use of the six paths framework under the blue ocean model and framework to reduce, contain and identify the search risk that many businesses are challenged within their expansion plans. By using this framework, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is able to identify the numerous possibilities associated with expanding into an untapped market space, which allows it to reconstruct the industry boundaries and structures towards innovation and new value creation.

4.1. Six paths

The six paths that Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts makes use of are:

4.1.1. Industry

Compared to red ocean players who focus on competing with exiting rivals within an industry, blue ocean players like Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts are able to expand beyond existing players. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts looks at alternative industries, and alternate possibilities in its expansion and growth plans, and as such, renders existing competition irrelevant.

4.1.2. Strategic group

Red ocean players focus one existing strategic groups for positioning possibilities, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts, on the other hand, looks beyond the existing strategic groups within an industry, and in turn, creates new strategic positioning and groups with first-mover advantage, and through exploring new market possibilities ad spaces.

4.1.3. Buyer group

Red ocean players continually eek to serve better-existing consumer groups. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts in turn also focuses on creating new demand and creating new consumer groups to be able to expand its overall customer base. In doing so, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is able to redefine the buyer group and consumers for the industry – by identifying new and potential consumer groups as well.

4.1.4. Scope of product or service offering

Red ocean players focus on improving the core product offering to e babel to better serve the consumers. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts, in turn, seeks not only to meet consumer expectations but to move across to be able to delight them. This is done by the company by focusing on consumer service, adding complementary offerings, as well as enhancing the service offerings for the consumers.

4.1.5. Functional-emotional orientation

Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is able to innovate the functional-emotional orientation of the industry through its strategic choices and direction, as well as creativity and foresight. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is able to develop and create new market spaces and new demand for its products and offerings – highlighting innovation which is needed for redefining the industrial focus, and changing the balance of emotional and functional orientation within a given industry to better appeal to the target consumer groups.

4.1.6. Time

Red ocean players adapt to external trends and patterns in the external environment and incorporate them in their strategic decisions and directions. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts in turn, seeks to influence the external trends and patterns in an industry’s environment. Instead of being reactive, it is more proactive in nature and actively seeks to enhance the business environment through influencing it over time with its actions, strategies and philosophies.

5. Three tiers of non-customers

To tap into unexplored market spaces and create new demand, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts has invested considerably in market research, and in understanding consumer trends and behavioral patterns. This research is especially focused on non-customers, and how to unlock them to create new demand for the company’s offerings. While Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts strives to maintain and expand its current consumer base, it must do so by tapping into new consumer groups.

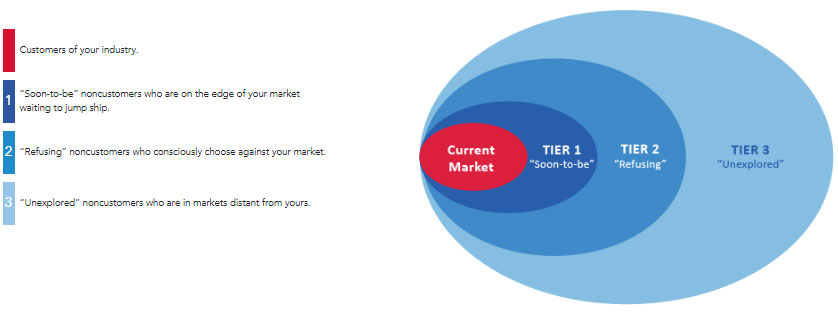

Figure 1 non-consumer groups of an industry

The first group of non-consumers for Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts are those who make minimal purchases of industry products – only out of necessity and are deemed to be non-customers. The second group involves those consumers who decline an industry’s offerings. This group has awareness about the industry’s offerings and benefits, but refuse to participate as active consumer groups., and instead, refuse to make the purchases altogether. The third group is the most away from the company, and have not considered the industry’s offerings as a possibility al att. These consumers are not interest or non-aware of the offerings.

Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts makes use of blue ocean networks and models to pull in the non-consumers and convert them into customers through strategic decisions and planning.

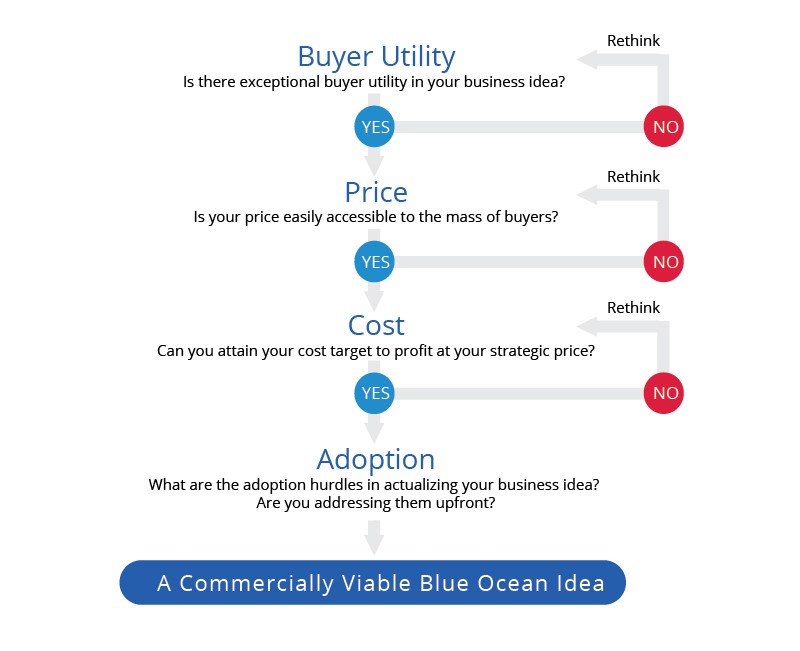

6. The sequence of creating a blue ocean value innovation

Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts has made use of the blue ocean strategy optimally by making use of the framework to sequence its strategy to be able to gain the highest benefit and profit from it. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts makes use of the optimal sequencing for value innovation under the blue ocean strategy i.e. buyer utility, price, cost, and adoption. By making use of this sequence, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is able to tap into the blue oceans of untapped market places and make sure that its growth is coming from unused market spaces, and is organic in terms of demand creation. With this sequence, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts has also been able to reduce the risks of expansion and internationalization, and at the same time, also ensured that maximum value is created and enjoyed not only by the customers but also by the company itself in the untapped and new market spaces.

Figure 2 sequence of creating buyer value under the blue ocean model

6.1. Blue ocean value creation sequence

The sequence adopted by Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts makes perfect sense for expansion and business development.

- Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts ensures that its product offerings are developed, and marketed to convey exceptional utility for buyers and consumers in its markets. Though Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts manufactured products that require a low emotional attachment, the offerings and products are often repeatedly purchased for the gratification they offer. For Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts, this is achieved through marketing activities, where the company markets, and advertises its products to deliver exceptional buyer utility.

- Based on the product offerings, its nature, and its characteristics, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts ensures that the offerings are appropriately priced. This pricing strategy is maintained not only to attract new consumers, and penetrate existing consumer groups, but also to attract, and appeal to the masses. The products are priced to attract the maximum number of buyers from the target audience groups of the Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts Company’s products to determine the affordability of its audience. This affordability and purchase will lead to a ripple effect in terms of buzz generation for the product.

- After securing the revenue aspects of the model in the sequencing, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts also ensures that it contains the costs of operations and manufacturing so as to derive a profit from its operations. Profit here is defined as the price of the products less the cost of production for the company – and involved fixed and variable costs. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts ensures that its costs are maintained through economies of scale and that its product prices are not driven up because of the increase in costs. This price maintenance is important to attract the target consumers and benefit from the blue ocean maximally.

- Finally, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts assesses the business environment and the consumer market and reviews it for any obstacles or hurdles in the process of adoption of the products in the blue ocean region. The company eliminates these hurdles and obstacles earlier along the way to prevent Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts form actualizing its goals and targets.

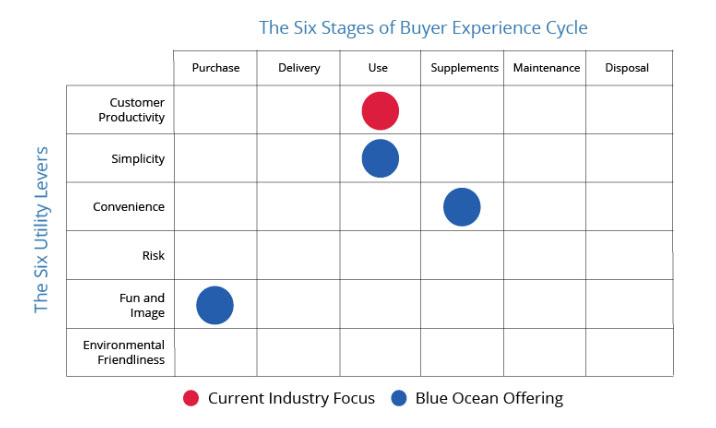

7. Buyer Utility Map

Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts also makes use of the buyer utility map in its exploration of untapped market spaces for purposes of growth and expansion. The buyer utility map helps Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts understand consumer’s betters, and also allows Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts to think, and perceive from a buyer's point of view. As such, the company is able to explore the demand side better, and also allows Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts to devise innovative ways to enhance the buyer utility that are different dim the conventional utility measures. Exploration of the demand side also helps Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts develop new experiences for buyers with its offerings – to help enhance their relation and interaction with the products, and increase the offerings’ appeal. Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is thus able to identify different and various utility spaces that its offerings can potentially fill.

Figure 3 utility maps under the blue ocean model

The utility maps are based on two dimensions - The Buyer Experience Cycle (BEC) and the Utility levers.

7.1. Buyer experience cycle and utility levers

The BEC is the cycle or process through which a consumer interacts, consumers, and disposes of the product. It generally occurs in six phases – and runs from purchase to disposal stage.

The utility levers, in turn, are the ways through which Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts can increase and enhance the utility of its offerings across the six stages of BEC for the consumers – thereby increasing the overall utility of the product.

7.2. Utility maps and value creation in the blue ocean

By identifying new and different utility spaces for consumers, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is able to identify new ideas and concepts that will help it tap into new consumer groups, and convert non-consumers onto avid consumers of its offerings. At the same time, the buyer utility amp also helps Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts in identifying spaces for differentiation of its products and creating new value propositions for the consumers – playing on the differentiation aspect as well.

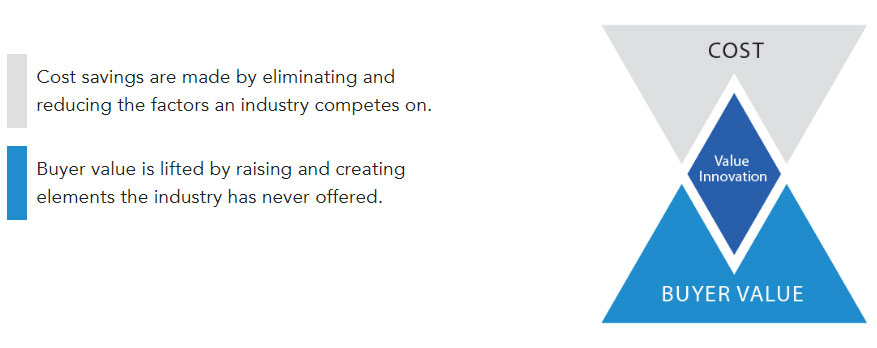

8. Value innovation

One of the tools that Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts employs in its application of the blue ocean strategy is the value innovation model or framework. With the value innovation framework, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is able to continually and simultaneously pursue a strategy of differentiation and low cost. By doing this, Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is able to create enhanced and increased value for not only itself but also for its customers. This enhanced and increased value is developed because of value innovation.

8.1. Creating value innovation: buyer vs. manufacturer

Value innovation is the pivotal factor that has helped Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts in developing and creating new demand by identifying and tapping into unexplored market spaces. With value innovation, the company has been able to continually refine its market-creating strategy, and develop new markets for its products, and product invocations. For value innovation, it is important to understand that customers gain value from the product’s utility less than the price paid. In contrast, value for manufacturers or companies – such as Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts, is derived based on the product’s price less the cost. Value innovation for Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts is achieved by aligning the aspects of price, cost, and utility. With this value innovation, a value leap is developed which enhances the value of the product for the customer as well as for Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts.

Figure 4 value innovation under the blue ocean model

9. References

Agnihotri, A., 2016. Extending boundaries of blue ocean strategy. Journal of Strategic Marketing, 24(6), pp.519-528. Mebert, A. and Lowe, S., 2017. Blue Ocean Strategy: How to Create Uncontested Market Space. Macat Library.

Alam, S. and Islam, M.T., 2017. Impact of blue ocean strategy on organizational performance: A literature review toward implementation logic. IOSR Journal of Business and Management, 19(1).

Bowonder, B., Dambal, A., Kumar, S. and Shirodkar, A., 2010. Innovation strategies for creating competitive advantage. Research-technology management, 53(3), pp.19-32.

Burke, A., van Stel, A. and Thurik, R., 2010. Blue ocean vs. five forces. Harvard Business Review, 88(5), pp.28-29.

Burke, A.E., Van Stel, A.J. and Thurik, R., 2009. Blue ocean versus competitive strategy: theory and evidence. ERIM Report Series Reference No. ERS-2009-030-ORG.

Hyde, A., 2013. Innovation–The Way Forward for Competitive Advantage? A Critical Review of Blue Ocean Strategy, Disruptive Innovation, and Strategic Innovation. OTAGO MANAGEMENT GRADUATE, p.31.

Jacobides, M.G., 2010. Strategy tools for a shifting landscape. Harvard Business Review, 88(1), pp.76-84.

Kim, S., In, H.P., Baik, J., Kazman, R. and Han, K., 2008. VIRE: Sailing a blue ocean with value-innovative requirements. IEEE software, 25(1), pp.80-87.

Kim, W.C. and Mauborgne, R., 2005. Value innovation: a leap into the blue ocean. Journal of business strategy.

Kim, W.C. and Mauborgne, R., 2014. Blue ocean leadership. Harvard business review, 92(5), pp.60-72.

Kim, W.C. and Mauborgne, R., 2014. Blue ocean strategy, expanded edition: How to create uncontested market space and make the competition irrelevant. Harvard business review Press.

Kim, W.C. and Mauborgne, R., 2015. Red ocean traps. Harvard business review, 93(3), pp.68-73.

Kim, W.C., 2005. Blue ocean strategy: from theory to practice. California management review, 47(3), pp.105-121.

Knowles, L., 2019. Blue Ocean Shift: Beyond Competing, Proven Steps to Inspire Confidence and Seize New Growth. Journal of Multidisciplinary Research, 11(1), p.119.

Lindič, J., Bavdaž, M. and Kovačič, H., 2012. Higher growth through the Blue Ocean Strategy: Implications for economic policy. Research policy, 41(5), pp.928-938.

Mauborgne, R. and Kim, W.C., 2005. Blue ocean strategy. Harvard Business Review, 1, p.256.

Mi, J., 2015. Blue ocean strategy. Wiley Encyclopedia of Management, pp.1-1.

Parvinen, P., Aspara, J., Hietanen, J. and Kajalo, S., 2011. Awareness, action and context‐specificity of blue ocean practices in sales management. Management Decision.

Rafique, M., Evans, R.D. and Nawaz, M.T., 2015, November. Absorptive capacity: A hub of Blue Ocean and red ocean strategies and capability transformation in innovative business environments. In 2015 2nd International Conference on Knowledge-Based Engineering and Innovation (KBEI) (pp. 60-65). IEEE.

TN, S.K., 2008. Blue ocean strategy: how to create uncontested market space and make the competition irrelevant. South Asian Journal of Management, 15(2), p.121.

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here.

Related Articles

- Corporate Social Responsibility of Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

- Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts 5C Marketing Analysis

- The vision statement of Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

- Organizational Culture of Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

- Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts Generic and Intensive Growth Strategies

- Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts Case Study Analysis & Solution

- Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts Case Solution

- Ansoff Matrix of Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

- Hofstede Cultural Model of Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

- Porters Diamond Model of Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

- Mckinsey 7s Framework Of Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

- Resource Based View Of The Firm - Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

- VRIN/VRIO Analysis Of Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

- Net Present Value (NPV) Analysis of Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

- WACC for Extending the Profit Elasticity Measure of Operating Leverage in Managerial Economics Texts

Nicole Chan

5.0

Obtained 80% marks from the assignment that was originated by this service because the writer was very supportive. Thank you!

Darius Roberto

5.0

Timely delivery and without plagiarism assignment. Great job!

Anna Jonas

5.0

The expert used the scholarly references in the MLA style and all statements in the paper were also accurate. Thanks!

Nestor Garcia

5.0

PPT presentation demands the words-limit with the clearance of the points. I appointed this service to overcome the trouble of words. I received the excellent paper with the perfect charges.

Wang Li

5.0

Received a shallow document from another service and appointed this one. The document that I received from this service leveled up the marks. Thanks!

Luciano Vesuvio

5.0

This custom paper writing exceeded my expectations and I'm more than happy because I obtained an A+ in the assignment that was delivered by this service. Recommended!

Next Articles

- 46922-The-Monetary-Approach-to-Balance-of-Payments-A-Taxonomy-with-a-Comprehensive-Reference-to-the-Literature-Blue-Ocean-Strategy

- 46923-The-Market-Attitudes-Inventory-The-Development-and-Testing-of-Reliability-and-Validity-Blue-Ocean-Strategy

- 46924-Dagwood-Doesn-t-Work-Here-Anymore-The-Denominator-Unemployment-and-War-Blue-Ocean-Strategy

- 46925-The-Correlation-Between-Teaching-Attributes-and-the-Instructor-s-Rating-Blue-Ocean-Strategy

- 46926-Economics-and-Business-Education-A-Comparative-Study-of-the-Ukraine-and-the-United-States-Blue-Ocean-Strategy

- 46927-Personality-Type-as-a-Determinant-of-Student-Performance-in-Introductory-Economics-Macroeconomics-vs-Microeconomics-Blue-Ocean-Strategy

- 46928-Teaching-Comparative-Advantage-and-International-Trade-Pitfalls-and-Opportunities-Blue-Ocean-Strategy

- 46929-Monetary-Policy-and-Housing-Market-Cointegration-Approach-Blue-Ocean-Strategy

- 46930-An-Approach-for-Solving-the-Coming-Financial-Crisis-in-Social-Security-Blue-Ocean-Strategy

- 46931-Foreign-Direct-Investment-in-the-United-States-Country-Analysis-Blue-Ocean-Strategy

Previous Articles

- 1-Making-the-Case-Blue-Ocean-Strategy

- 2-Joe-Smith-s-Closing-Analysis-B-Blue-Ocean-Strategy

- 3-Joe-Smith-s-Closing-Analysis-A-Spanish-Version-Blue-Ocean-Strategy

- 4-GMAC-The-Pipeline-Blue-Ocean-Strategy

- 5-On-Writing-Teaching-Notes-Well-Blue-Ocean-Strategy

- 6-Exxon-Corp-Trouble-at-Valdez-Blue-Ocean-Strategy

- 7-Ashland-Oil-Inc-Trouble-at-Floreffe-A-Blue-Ocean-Strategy

- 8-Ashland-Oil-Inc-Trouble-at-Floreffe-B-Blue-Ocean-Strategy

- 9-Ashland-Oil-Inc-Trouble-at-Floreffe-C-Blue-Ocean-Strategy

- 10-Ashland-Oil-Inc-Trouble-at-Floreffe-D-Blue-Ocean-Strategy

Be a Great Writer or Hire a Greater One!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Essay48 with BIG enough reputation.

Our Guarantees

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!