Mckinsey 7s Framework Of Dolphin Capital Investors Limited

Posted by Matthew Harvey on Feb-11-2020

Introduction

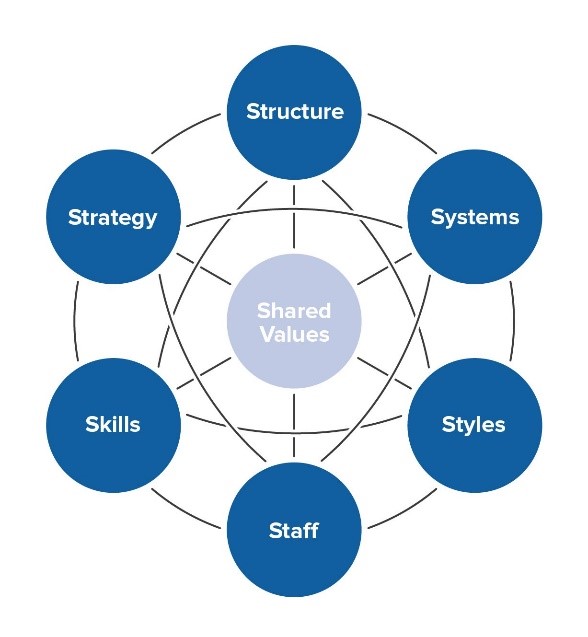

The McKinsey 7s model is a strategic tool and framework that helps managers and businesses assess their performance. The McKinsey 7s model identifies 7 key elements for an organization that need to be focused and aligned for successful change management processes as well as for regular performance enhancements.

Figure 1 McKinsey 7S Model

The 7 elements identified in the McKinsey 7s model can be categorized as being hard or soft in nature. They are identified as:

| Hard Elements | Soft Elements |

|---|---|

| Shared Values | |

| Strategy | Skills |

| Structure | Style |

| Systems | Staff |

Figure 2 Hard and Soft elements of the McKinsey 7S Model

Dolphin Capital Investors Limited makes use of the McKinsey 7s model to regularly enhance its performance, and implement successful change management processes. Dolphin Capital Investors Limited focuses on the 7 elements identified in the model to ensure that its performance levels are consistently maintained, and improved for the offerings.

1. Hard elements

The hard elements of the McKinsey 7s model comprise of strategy, structure, and systems. The hard elements of the model are easier to identify, more tangible in nature, and directly controlled and influenced by the leadership and management of the organization.

1.1. Strategy

1.1.1. Clearly defined

The strategic direction and the overall business strategy for Dolphin Capital Investors Limited are clearly defined and communicated to all the employees and stakeholders. This helps the organization manage performance, guide actions, and devise different tactics that are aligned with the business strategy. Moreover, the business strategy’s definition and communication also make operations for Dolphin Capital Investors Limited more transparent and aligns the responsibilities and actions of the company.

1.1.2. Guiding behaviour for goal attainment

The strategic direction for Dolphin Capital Investors Limited is also important in helping the business guide employee, staff, and stakeholder behaviour towards the attainment and achievement of goals. SMART Goals are set with short and long term deadlines in accordance with the business strategy. The business strategy helps employees decide tactics and behaviours for attaining the set goals and targets to help the business grow.

1.1.3. Competitive pressures

Dolphin Capital Investors Limited’s strategy also takes into consideration the competitive pressures and activities of competitors. The strategy addresses these competitive pressures through suggestive measures and actions to address competition via strategic tactics and activities that ensure sustainability to Dolphin Capital Investors Limited via adapting to market changes, and evolving consumer trends and demands.

1.1.4. Changing consumer demands

An important aspect of the strategy at Dolphin Capital Investors Limited is that it takes into constant consideration the changing consumer

trends and demands, as well as the evolving consumer market patterns and consumption behavior. This is an important

part of the strategic direction at Dolphin Capital Investors Limited as it allows the company to remain competitive and relevant to its target

consumer groups, as well as allows the company to identify demand gaps in the consumer market.

The company

then strategically addresses these gaps through product offerings and marketing activities which give the company

successful and leading-edge over other patterns in the market.

1.1.5. Flexibility and adaptability

The strategy at Dolphin Capital Investors Limited is flexible and adaptable. This is an important aspect of the strategic direction, and strategy setting at Dolphin Capital Investors Limited. Rigidity in strategy leads a company and a business to often become stagnant and obstructs advancement, and progression with evolving changes in the consumer markets.

With flexibility and adaptability, the Dolphin Capital Investors Limited is not only able to benefit from quickly reacting and responding to changing consumer patterns globally, but is also able to locally and culturally adapt its products via localization for different countries and regions. Moreover, the company is often able to proactively predict consumer market changes, and devise strategic changes accordingly to meet the market trends.

1.2. Structure

1.2.1. Organizational hierarchy

Dolphin Capital Investors Limited has a flatter organizational hierarchy that is supported by learning and progressive organizations. With lesser managerial levels in between and more access to the senior management and leadership, the employees feel more secure and confident and also have higher access to information. Moreover, the flatter hierarchy also allows quicker decision-making processes for Dolphin Capital Investors Limited and increases organizational commitment in the employees.

1.2.2. Inter-Departmental coordination

Dolphin Capital Investors Limited has high coordination between different departments. The company’s departments often form inter-department teams for projects and tasks that require multiple expertise. All coordination between different departments is effective and organized. Dolphin Capital Investors Limited has a systematic process for initiating and monitoring coordination between departments to ensure smooth work operations and processes – and goal attainment.

1.2.3. Internal team dynamics [department specific]

Dolphin Capital Investors Limited encourages teamwork and team-oriented tasks. Where jobs require individual attention and scope, the company also assigns individual responsibilities and job tasks. However, all employees at Dolphin Capital Investors Limited are expected to be team players who can work well with and through other members, and who get along well with other people. The teams at Dolphin Capital Investors Limited are supportive of all embers and work in synch with synergy towards achieving the broader team objectives and goals under the Dolphin Capital Investors Limited designed strategy and values.

1.2.4. Centralization vs. decentralization

Dolphin Capital Investors Limited has a hybrid structure between centralization and decentralization. Like many progressive organizations, Dolphin Capital Investors Limited largely supports decentralized decision making. Job roles at Dolphin Capital Investors Limited are designed to be carried out with responsibility, and employees often set their goals with mutual coordination and understanding with the supervisors.

However, Dolphin Capital Investors Limited is also centralized in making sure that supervisors oversee, and approve of the various efforts, and tactics that employees choose to ensure that they are aligned with the organizational strategy ad values.

1.2.5. Communication

Dolphin Capital Investors Limited has a developed and intricate system for ensuring communication between employees, and different managerial levels. The communication systems at Dolphin Capital Investors Limited enhance the overall organizational structure. The systematic, defined, and organized communication allows an easy flow of information and ensures that no organizational tasks and goals are compromised because of a lack of communication, or misunderstandings.

1.3. Systems

1.3.1. Organizational systems in place

Dolphin Capital Investors Limited has defined and well-demarcated systems in place to ensure that the business operations are managed effectively and that there are no conflicts or disputes. The systems at Dolphin Capital Investors Limited are largely departmental in nature, and include, for example:

- Human resource management

- Finance

- Marketing

- Operations

- Sales

- Supply chain management

- Public Relation Management

- Strategic leadership

1.3.2. Defined controls for systems

Each of the defined and demarcated systems at Dolphin Capital Investors Limited has especially designed tools and methods as controls for evaluating performance and goal attainment. These controls and measures are designed specifically in different departments based on the nature of their tasks and responsibilities. Moreover, each department also designs specific controls for members for performance evaluation, as well as for inter-departmental tasks and responsibilities.

1.3.3. Monitoring and evaluating controls

Dolphin Capital Investors Limited continually evaluates its systems through the designed controls. This monitoring of the performance is continual and ongoing. This is largely done through observation and informal discussions. Feedback to employees and overall department heads is informally given regularly as and when is required. Formal evaluation of performance is also conducted semiannually – or quarterly, depending on the need and the urgency of the projects and assigned tasks. This is a formal process that is undertaken by supervisors and managers to ensure the identification of performance lags, and suggestive means of improvement.

1.3.4. Internal processes for organizational alignment

Dolphin Capital Investors Limited also has special processes and methods for ensuring that all departments and systems within the organization are aligned and working in harmony towards the greater business goals and targets. This is made possible through ensuring that all systems are designing and working towards goals and targets specific to their expertise under the broader business vision and strategy. Moreover, the strategic leadership at Dolphin Capital Investors Limited also ensures that all systems are allocated with resources, and set specific targets to achieve similar business goals in any specific period.

2. Soft elements

The soft elements of the McKinsey 7s model, in turn, include shared values, staff, skills, and strategy. These elements are less tangible in nature and are more influenced by the organizational culture. As such, the management does not have direct influence or control over them. These elements are also harder to describe and directly identify – but are equally important for an organization’s success and improved performance.

2.1. Shared values

2.1.1. Core values

The core values at Dolphin Capital Investors Limited are defined and communicated to foster a creative and supportive organizational structure that will allow employees to perform optimally, and enhance their motivation and organizational commitment. The core values at Dolphin Capital Investors Limited include, but are not limited to:

- Creativity

- Honesty

- Transparency

- Accountability

- Trust

- Quality

- Heritage

The Dolphin Capital Investors Limited business also ensures that all its activities and operations are conducted with high ethical and moral standards that redefined and benchmarked against international criteria.

2.1.2. Corporate culture

Dolphin Capital Investors Limited encourages an inclusive culture that celebrates diversity. The company has an international presence, and production units that are spread across different countries, as such, Dolphin Capital Investors Limited ensure that its organizational culture is supportive of diversity, and has internal policies to reduce incidences of discrimination.

The corporate culture at Dolphin Capital Investors Limited also encourages innovation and creativity by allowing independence for growth to individuals and teams –thus helping them refine their careers as well as personalities. Lastly, the corporate culture at Dolphin Capital Investors Limited also has a supportive leadership which works towards increasing employee motivation and job satisfaction by giving way to visibility and accessibility.

2.1.3. Task alignment with values

Dolphin Capital Investors Limited ensures that all its job tasks and roles are aligned with the core values that the company propagates. This means that all activities, tactics, and strategic tactics employed by Dolphin Capital Investors Limited will reflect its core values, and will not deviate away from these. This is to ensure a consistent, and reliable brand image, as well as an honest organizational culture. In the event of organizational change, the company will continue to ensure that all change management processes and methods incorporate the core values so that the organizational culture is consistently maintained, and systematically changed if need be.

2.2. Style

2.2.1. Management/leadership style

Dolphin Capital Investors Limited has a participative leadership style. Through a participative leadership style, Dolphin Capital Investors Limited is able to engage and involve its employees in decision-making processes and managerial decisions. This also allows the leadership to regularly interact with the employees and different managerial groups to identify any potential conflicts for resolution, as well as for feedback regarding strategic tactics and operations. Through its participative leadership, Dolphin Capital Investors Limited is able to enhance employee motivation, and increase organizational commitment and ownership amongst employees as well as other stakeholders.

2.2.2. Effectiveness of leadership style

The participative leadership style is highly effective in achieving the business goals and vision of the organization. Employees feel to be active members of the organization who are valued for their suggestions, feedback, and input. Moreover, through participative leadership, leaders and managers are able to identify current and potential conflicts within the Dolphin Capital Investors Limited organization, and actively work to resolve them as soon as possible.

2.2.3. Cooperation vs competition – internally

With its supportive and encouraging organizational culture, Dolphin Capital Investors Limited gives way to internal collaboration and cooperation between employees, systems, teams, and departments. This cooperation and collaboration at Dolphin Capital Investors Limited is important since its operations are spread globally, and also because tasks and responsibilities within the company often require inter-departmental feedback and input. Moreover, with increased expansion, and synergy, the business also regularly forms project teams – which function effectively because of the cooperative and collaborative culture within the Dolphin Capital Investors Limited organization.

2.2.4. Team vs groups

Dolphin Capital Investors Limited has effective and functional teams and works with them internally to achieve its various business goals and objectives, and complete tasks. The company’s management is encouraging and supportive, and the leadership provides a motivating and pragmatic vision toad achieve. The human resource management system, as well as the organizational training, supports all employees in their growth fairly and transparently. This leads to effective team formation instead of nominal groups within the organization for various projects, as well as department-specific tasks and roles.

2.3. Staff

2.3.1. Employee skill level vs business goals

Dolphin Capital Investors Limited has a sufficient number of employees employed across its global operations. Employees for different job roles and positions are hired internally as well as externally – depending on the urgency and the skill levels required. Based on this, it is seen that Dolphin Capital Investors Limited has employees who are skilled as per the requirements of their job roles and positions. All employees are given in house training to familiarize themselves with the company and its values. External training along with in-house training is provided for skill level enhancement.

All job roles and positions are designed to facilitate the achievement of business goals, and as such, employee skill level at Dolphin Capital Investors Limited is sufficient to achieve the business goals of the company.

2.3.2. Number of employees

Dolphin Capital Investors Limited has employed a large number of employees. The number of employees varies from country to country as per the requirements and needs of the business and operations. The global team of Dolphin Capital Investors Limited is an inclusive one that accepts, and encourages diversity, and works in synchronization with members to ensure attainment of business goals. The team member sand employees are the most important part of business success for Dolphin Capital Investors Limited.

2.3.3. Gaps in required capabilities and capacities

Dolphin Capital Investors Limited has a well-defined system for identifying potential needs of capabilities and capacities for the organization. The human resource function of the business has a systematic process that aligns all other departments to identify potential vacancies or skill gaps. Based on the nature of the need, the human resource department arranges for recruitments which may be permanent or contractual in nature, as well as arranges training sessions if need be for the current workforce.

2.4. Skills

2.4.1. Employee skills

Dolphin Capital Investors Limited has a commendable workforce, with high skills and capacities. All employees are recruited based on their merit and qualifications. Dolphin Capital Investors Limited prides itself on hiring the best professionals and grooming them further to facilitate growth and development.

2.4.2. Employee skills vs task requirements

Dolphin Capital Investors Limited has defined tasks and job roles and hires and trains employees for skill levels accordingly with respect to those. The company ensures that all its job requirements are met and that employees have the sufficient skills to perform their respective jobs in accordance with the values and culture as well as the business goals and strategy of Dolphin Capital Investors Limited.

2.4.3. Skill management

Dolphin Capital Investors Limited pays particular attention to enhancing the skills and capacities of its employees. It arranges regular training and workshops – internally as well as externally managed- to provide growth and development opportunities for its employees. Dolphin Capital Investors Limited focuses on personal as well as professional growth for its employees and works accordingly with them.

2.4.4. Company’s competitive advantage

The human resource is one of the core competitive advantages of the company. The skills of employees are developed specifically for job roles and requirements at Dolphin Capital Investors Limited and provide a competitive benefit to the company – where players cannot imitate employee skills or training. This creates a unique and non-substitutable competency for Dolphin Capital Investors Limited.

3. References

Alam, P.A., 2017. Measuring Organizational Effectiveness through the Performance Management System and Mckinsey's 7 S Model. Asian Journal of Management, 8(4), pp.1280-1286.

Allaoui, S., Bourgault, M. and Pellerin, R., 2019. Business transformation frameworks: Comparison and industrial adaptation. Journal of Enterprise Transformation, pp.1-28.

Arvand, N. and Baroto, M.B., 2016. How to implement strategy more effectively. International Journal of Business Performance Management, 17(3), pp.301-320.

Baishya, B., 2015. McKinsey 7s Framework in corporate planning and policy. International Journal of Interdisciplinary Research in Science Society and Culture (IJIRSSC), 1(1), pp.165-168.

Channon, D.F. and Caldart, A.A., 2015. McKinsey 7S model. Wiley encyclopedia of management, pp.1-1.

Cordell, A. and Thompson, I., 2019. The Procurement Models Handbook. Routledge.

Daft, R., 2016. Contemporary Strategy Analyses. New York: John Wiley & Sons.

Doumi, K., Baina, S. and Baina, K., 2013. STRATEGIC BUSINESS AND IT ALIGNMENT: REPRESENTATION AND EVALUATION. Journal of Theoretical & Applied Information Technology, 47(1).

Galli, B.J., 2018. Change management models: A comparative analysis and concerns. IEEE Engineering Management Review, 46(3), pp.124-132.

Gökdeniz, İ., Kartal, C. and Kömürcü, K., 2017. Strategic assessment based on 7S McKinsey model for a business by using analytic network process (ANP). International Journal of Academic Research in Business and Social Sciences, 7(6), pp.2222-6990.

Grant, R., 2010. Contemporary Strategy Analysis and Cases: Text and Cases. Hoboken: NJ: ohn Wiley & Sons.

Hossain, A., 2019. Strategy implementation: Identification of explanatory variables for successful business analytics implementation in organizations.

Hrebiniak, L., 2005. Making strategy work. Philadelphia, PA: Wharton School Publishing.

Johnson, G., 2016. Exploring strategy: text and cases. Pearson Education.

Král, P. and Králová, V., 2016. Approaches to changing organizational structure: The effect of drivers and communication. Journal of Business Research, 69(11), pp.5169-5174.

Puranam, P. and Vanneste, B., 2016. Corporate strategy: Tools for analysis and decision-making. Cambridge University Press.

Ravanfar, M.M., 2015. Analyzing Organizational Structure based on the 7s model of McKinsey. Global Journal of Management And Business Research.

Shaqrah, A.A., 2018. Analyzing business intelligence systems based on 7S model of McKinsey. International Journal of Business Intelligence Research (IJBIR), 9(1), pp.53-63.

Singh, A., 2013. A study of role of McKinsey's 7S framework in achieving organizational excellence. Organization Development Journal, 31(3), p.39.

Singh, R., 2018. Developing Competitive Strength: Biggest Challenge for the Organizations. Managing Editor, p.65.

Zincir, O. and Tunç, A.Ö., 2017. An Imagination of Organizations in the Future: Rethinking McKinsey's 7S Model. In Strategic Imperatives and Core Competencies in the Era of Robotics and Artificial Intelligence (pp. 101-125). IGI Global.

4. Appendix

| Hard elements |

|

||||||||

| Soft elements |

|

Table 1McKinsey 7S model - summary

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here.

Related Articles

- Corporate Social Responsibility of Dolphin Capital Investors Limited

- Dolphin Capital Investors Limited 5C Marketing Analysis

- The vision statement of Dolphin Capital Investors Limited

- Organizational Culture of Dolphin Capital Investors Limited

- Dolphin Capital Investors Limited Generic and Intensive Growth Strategies

- Marketing Mix Dolphin Capital Investors Limited

- Dolphin Capital Investors Limited PESTEL & Environment Analysis

- Dolphin Capital Investors Limited Porter Five Forces Analysis

- Dolphin Capital Investors Limited SWOT Analysis / SWOT Matrix

- Value Chain Analysis Of Dolphin Capital Investors Limited

- Marketing Strategy Of Dolphin Capital Investors Limited

- Dolphin Capital Investors Limited Case Solution

- Ansoff Matrix of Dolphin Capital Investors Limited

- Blue Ocean Strategy of Dolphin Capital Investors Limited

- Hofstede Cultural Model of Dolphin Capital Investors Limited

- Porters Diamond Model of Dolphin Capital Investors Limited

- Resource Based View Of The Firm - Dolphin Capital Investors Limited

- VRIN/VRIO Analysis Of Dolphin Capital Investors Limited

- Net Present Value (NPV) Analysis of Dolphin Capital Investors Limited

- WACC for Dolphin Capital Investors Limited

Xavier Rayder

5.0

When the plagiarism detection software scanned the paper, it contained zero plagiarism. Thanks!

Denis Flavo

5.0

This company is a gift for me because it never denies my instructions and arranges the more suitable charges with me as compared to others.

Benjamin Nathaniel

5.0

I value you guys work with the affordable fees and accept that you work for every student. Whoever wants to get good work should hire this service!

George Ben

5.0

Very glad with the paper and this service but very sad with those reviews that say it’s a scam. Thank you for the best paper.

David Jin

5.0

Want to rate this organization much more than five stars. I've been taking help from this service for two years and am always pleased with the document.

Nicholas Heon

5.0

I was inquisitive about what they can deliver within 8 hours. When the paper reached to me, I proofread it. It was absolutely accurate. Honestly, everyone was incompetent to write the assignment in such a short duration.

Next Articles

- 9329-Doric-Nimrod-Air-One-Limited-Mckinsey-7s

- 9330-Downing-Distribution-Vct-1-Plc-Mckinsey-7s

- 9331-Downing-Four-Vct-Plc-Mckinsey-7s

- 9332-Downing-Strategic-Micro-Cap-Investment-Trust-Plc-Mckinsey-7s

- 9333-Downing-Three-Vct-Plc-Mckinsey-7s

- 9334-Downing-Two-Vct-Plc-Mckinsey-7s

- 9335-Draganfly-Investments-Limited-Mckinsey-7s

- 9336-Dragon-Ukrainian-Properties-Development-Plc-Mckinsey-7s

- 9337-Draper-Esprit-Plc-Mckinsey-7s

- 9338-Drum-Income-Plus-Reit-Plc-Mckinsey-7s

Previous Articles

- 9327-Diverse-Income-Trust-The-Plc-Mckinsey-7s

- 9326-Direct-Line-Insurance-Group-Plc-Mckinsey-7s

- 9325-Derwent-London-Plc-Mckinsey-7s

- 9324-Derriston-Capital-Plc-Mckinsey-7s

- 9323-Davictus-Plc-Mckinsey-7s

- 9322-Damille-Investments-Ii-Limited-Mckinsey-7s

- 9321-Daejan-Holdings-Plc-Mckinsey-7s

- 9319-Cvc-Credit-Partners-European-Opportunities-Limited-Mckinsey-7s

- 9318-Custodian-Reit-Plc-Mckinsey-7s

- 9317-Curtis-Banks-Group-Plc-Mckinsey-7s

Be a Great Writer or Hire a Greater One!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Essay48 with BIG enough reputation.

Our Guarantees

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!